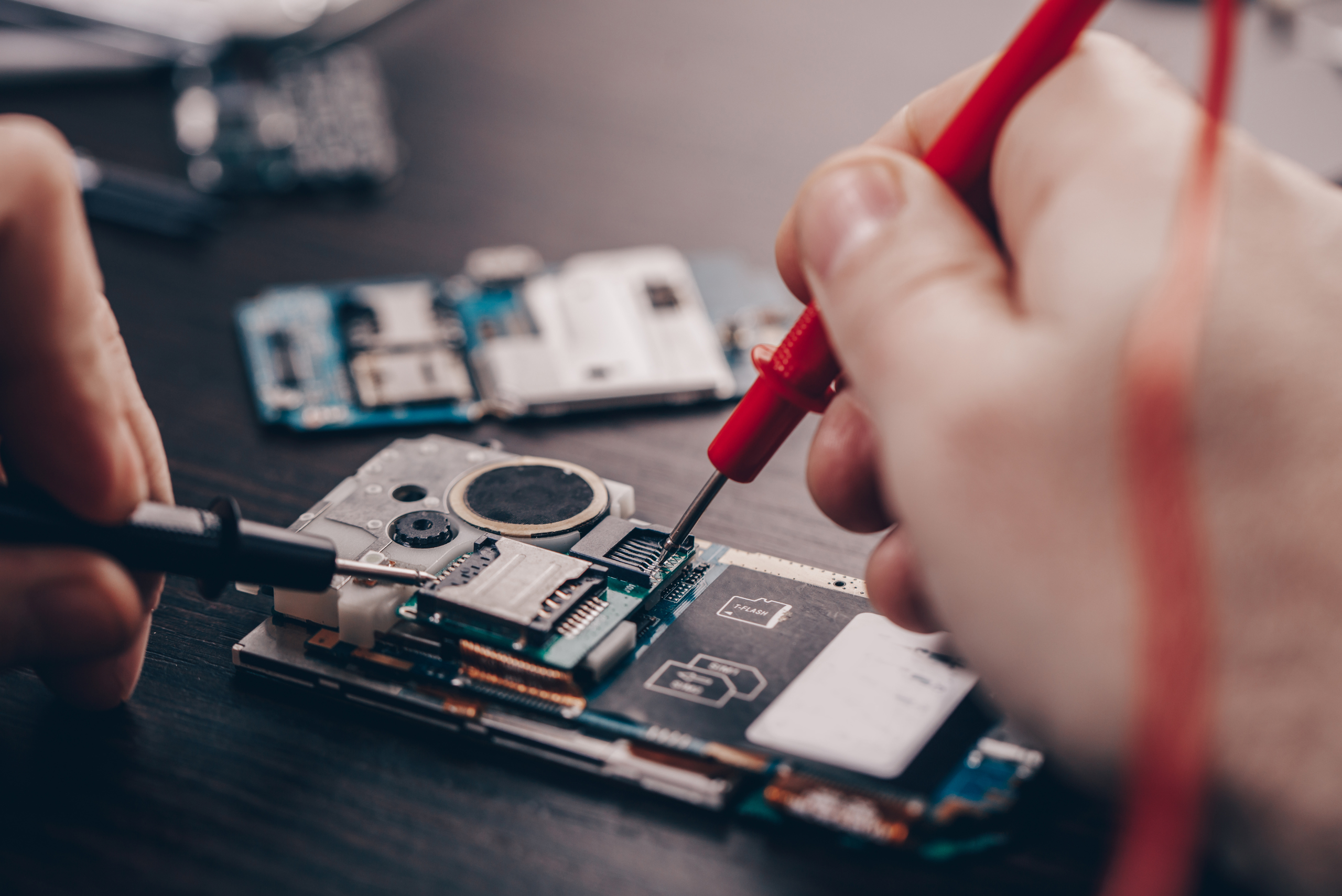

The government has clarified the definition of camera modules for mobile phones to ensure uniform classification and proper application of the 10% concessional BCD under Notification No. 57/2017-Customs. Only genuine camera modules qualify, while other mobile phone components are taxed separately.

Understanding the Clarification on Camera Module under Notification No. 57/2017-Customs

- Background of the Concession:

- Notification No. 57/2017-Customs dated 30.06.2017 provides a 10% concessional Basic Customs Duty (BCD) on camera modules used in manufacturing cellular mobile phones (S. No. 5A).

- Inputs, parts, and sub-parts used in manufacturing camera modules, such as camera lenses, are fully exempt from BCD (S. No. 6B & 6BA).

- Issue Raised by DRI:

- The Directorate of Revenue Intelligence (DRI) sought clarification regarding the scope of camera modules under S. No. 5A of the notification.

- Their concern arose because some camera modules were imported pre-fitted in a metal chassis, which also had spaces for other phone components.

- If the metal chassis were imported separately, it would attract 15% BCD (before 30.01.2024).

- Hence, doubts were raised about whether such assemblies should qualify as camera modules or be taxed differently.

- Clarification Issued Based on MeitY Inputs:

- The Ministry of Electronics and IT (MeitY) provided inputs through OM No. W-15/2/2024-IPHW dated 31.12.2024, leading to this clarification.

- The goal is to ensure uniform classification of camera modules and prevent misinterpretation.

- Key Clarifications on Camera Modules:

- Definition of Camera Module:

- A camera module consists of lens, sensor, Flexible Printed Circuit Board (FPCB) assembly, bracket/holder, connectors, and mechanical parts based on mobile phone design.

- The essential character of the camera module is determined by its function as a camera as per Rule 3(b) of the General Rules of Interpretation (GRI) of the Harmonised System.

- Since mobile technology evolves rapidly, parts and sub-parts may change over time, but classification should focus on the essential character of the module.

- When is a Camera Module Eligible for 10% Concessional BCD?

- If the imported assembly primarily functions as a camera module, it qualifies for the 10% concessional duty under S. No. 5A of the notification.

- Even if it includes brackets, connectors, or minor mechanical parts, as long as these do not add new functionalities beyond a camera, it remains classified as a camera module.

- Example: If the imported item consists of multiple cameras in a single unit with supporting structures for strength/stability, it is still treated as a camera module.

- When Does a Camera Module NOT Qualify?

- If the imported assembly includes additional mobile phone components (e.g., metal chassis with cavities for other parts, extra functional components), it does not qualify as a camera module.

- If individual parts of the camera module (lens, connectors, PCB, etc.) are imported separately, they attract regular BCD rates, not the concessional rate.

- Definition of Camera Module:

Notification Reference: Customs

Circular No. 08/2025 Customs

24/03/2025

Blog Views: 529